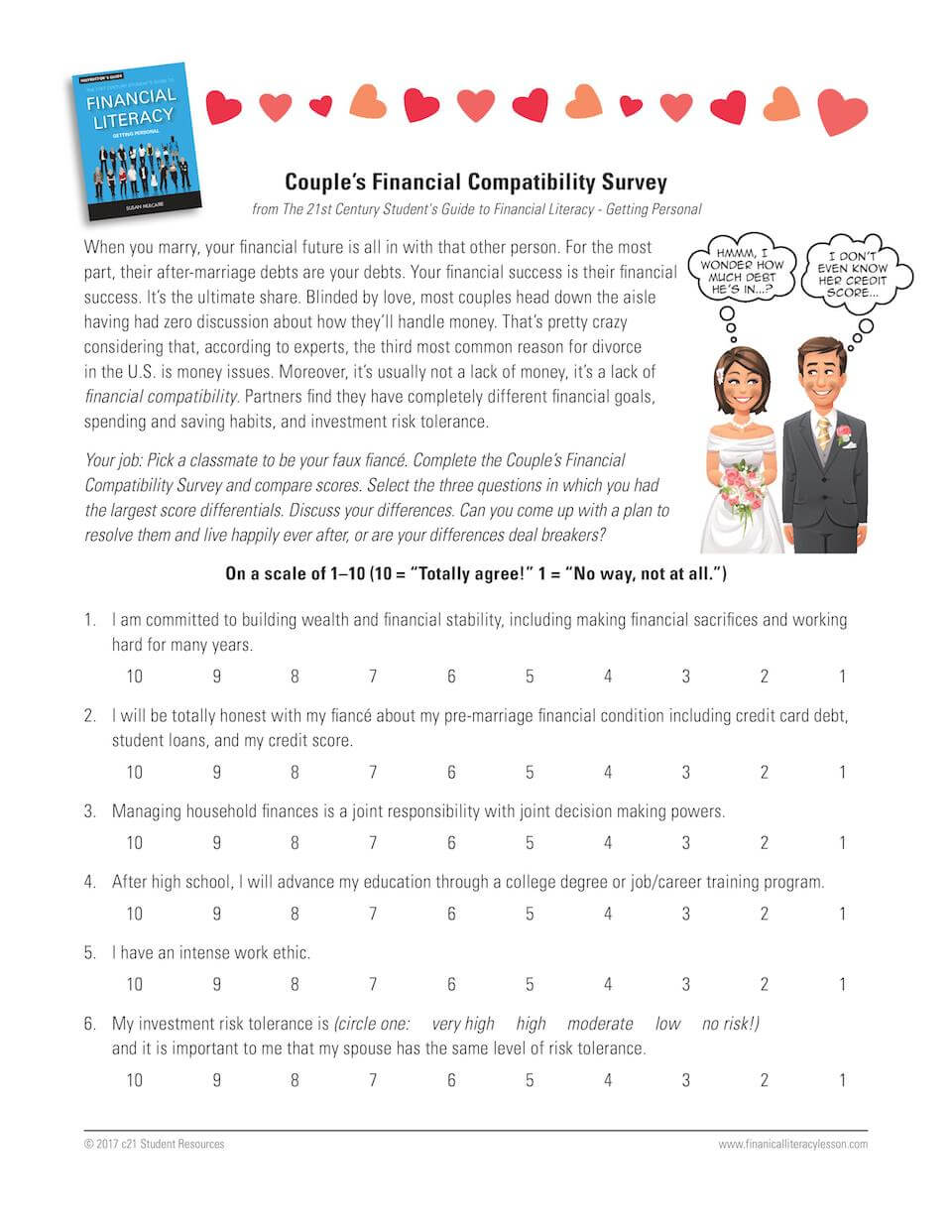

When you marry, your financial future is all in with that other person. For the most part, their after-marriage debts are your debts. Your financial success is their financial success. It’s the ultimate share.

Blinded by love, most couples head down the aisle having had zero discussion about how they’ll handle money. That’s pretty crazy considering that, according to experts, the third most common reason for divorce in the U.S. is money issues. Moreover, it’s usually not a lack of money, it’s a lack of financial compatibility. Partners find they have completely different financial goals, spending and saving habits, and investment risk tolerance.

Your job:

- Pick a classmate to be your faux fiancé.

- Complete the Couple’s Financial Compatibility Survey and compare scores.

- Select the three questions in which you had the largest score differentials.

- Discuss your differences.

Can you come up with a plan to resolve them and live happily ever after, or are your differences deal breakers?